What Items Are Considered Variable Cost . Tvc = total quantity of output * vc per unit of output. Here are a number of examples of variable costs, all in a production setting: a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. variable costs are any expense that increases or decreases with your production output. types of variable costs. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. Examples of variable costs include.

from exonzzjof.blob.core.windows.net

variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Tvc = total quantity of output * vc per unit of output. Examples of variable costs include. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. types of variable costs. As production increases, these costs. Here are a number of examples of variable costs, all in a production setting: variable costs are any expense that increases or decreases with your production output. a variable cost is any corporate expense that changes along with changes in production volume.

Fixed Cost And Variable Cost Pdf at Melissa Schroeder blog

What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. As production increases, these costs. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. Here are a number of examples of variable costs, all in a production setting: Examples of variable costs include. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. types of variable costs. a variable cost is any corporate expense that changes along with changes in production volume. variable costs are any expense that increases or decreases with your production output. Tvc = total quantity of output * vc per unit of output.

From www.investopedia.com

Variable Cost What It Is and How to Calculate It What Items Are Considered Variable Cost a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. a variable cost is any corporate expense that changes along with changes in production volume. Examples of variable costs include. variable costing is a concept used in managerial and cost accounting in which the fixed. What Items Are Considered Variable Cost.

From dxozkccud.blob.core.windows.net

Variable Cost Numerical Example at Brenda Zastrow blog What Items Are Considered Variable Cost types of variable costs. Examples of variable costs include. Tvc = total quantity of output * vc per unit of output. a variable cost is any corporate expense that changes along with changes in production volume. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you. What Items Are Considered Variable Cost.

From quickbooks.intuit.com

Variable costs A comprehensive guide QuickBooks What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. types of variable costs. As production increases, these costs. a variable cost is any corporate expense that changes along with changes. What Items Are Considered Variable Cost.

From www.akounto.com

Fixed vs. Variable Cost Differences & Examples Akounto What Items Are Considered Variable Cost a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. As production increases, these costs. a variable cost is the price of raw materials, labor, and distribution associated with each unit. What Items Are Considered Variable Cost.

From khatabook.com

What is Variable Cost Variable Cost Examples & How to Calculate Variable Cost What Items Are Considered Variable Cost types of variable costs. Here are a number of examples of variable costs, all in a production setting: a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded. What Items Are Considered Variable Cost.

From study.com

Variable Cost Definition, Formula & Examples Lesson What Items Are Considered Variable Cost As production increases, these costs. a variable cost is any corporate expense that changes along with changes in production volume. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. Tvc = total quantity of output * vc per unit of output. types of variable costs. variable. What Items Are Considered Variable Cost.

From www.deskera.com

What is Variable Cost? A Complete Guide What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. Examples of variable costs include. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead. What Items Are Considered Variable Cost.

From mailchimp.com

A Guide To Variable Costs Formulas + Tips Mailchimp What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. a variable cost is any corporate expense that changes along with changes in production volume. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Here are a number of examples of. What Items Are Considered Variable Cost.

From learn.financestrategists.com

Cost Allocation Definition Types Methods Process What Items Are Considered Variable Cost Tvc = total quantity of output * vc per unit of output. Here are a number of examples of variable costs, all in a production setting: examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. variable costs are any expense that increases or decreases with your production output.. What Items Are Considered Variable Cost.

From www.vecteezy.com

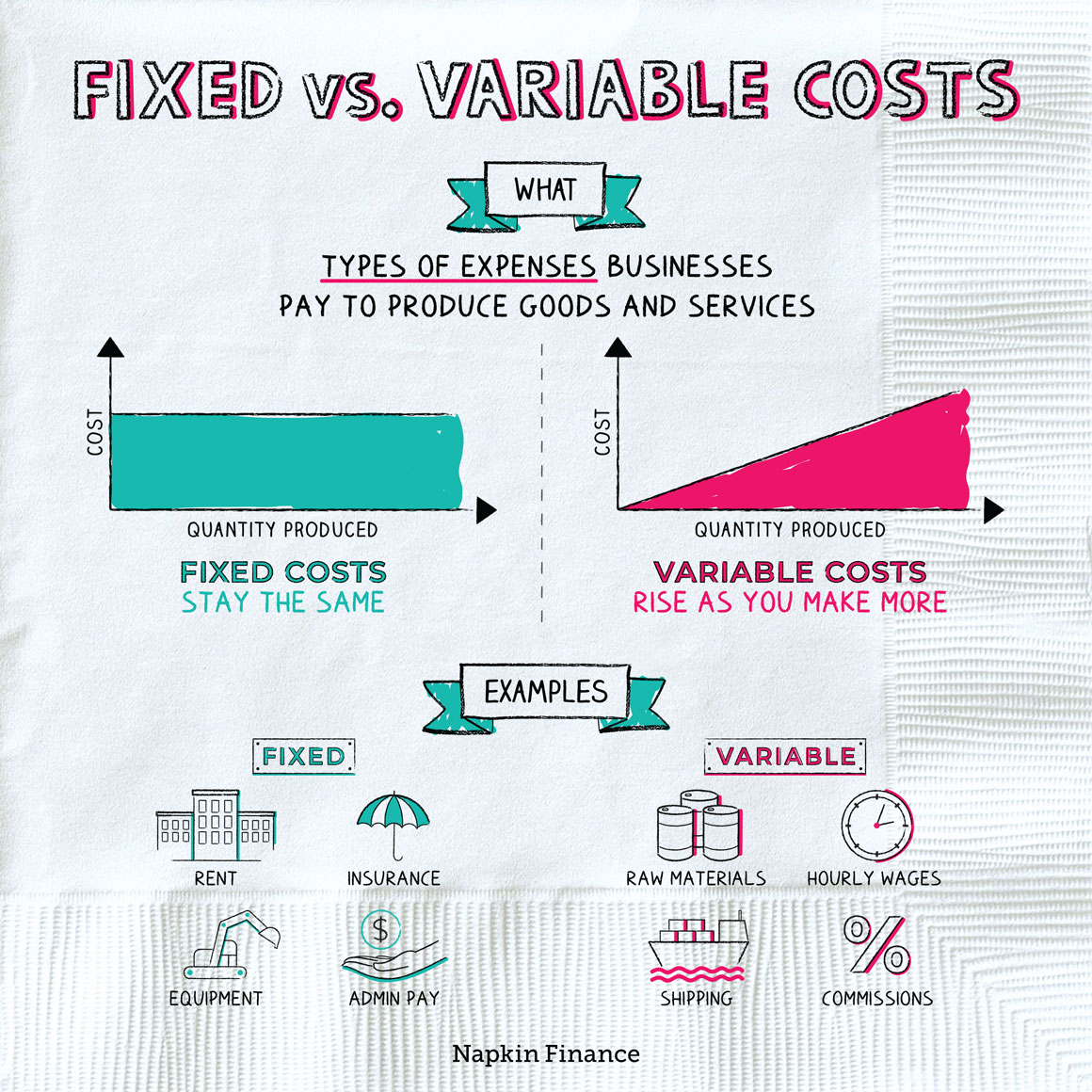

Fixed cost with no change in quantity of goods compare with variable cost with changes in the What Items Are Considered Variable Cost a variable cost is any corporate expense that changes along with changes in production volume. Tvc = total quantity of output * vc per unit of output. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. variable costing is a concept used in managerial. What Items Are Considered Variable Cost.

From wise.com

Variable Cost Definition, Formula and Calculation Wise What Items Are Considered Variable Cost variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. a variable cost is the price of raw materials, labor, and distribution associated with each unit of. What Items Are Considered Variable Cost.

From www.pinterest.com

Image titled Calculate Variable Costs Step 9 Economics Lessons, Fixed Cost, Variables What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. As production increases, these costs. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. Here are a number of examples of variable costs, all in a production setting: a variable cost is the price. What Items Are Considered Variable Cost.

From penpoin.com

Total Variable Cost Examples, Curve, Importance What Items Are Considered Variable Cost As production increases, these costs. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. types of variable costs. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. examples of variable costs. What Items Are Considered Variable Cost.

From 1investing.in

Variable Cost Explained in 200 Words India Dictionary What Items Are Considered Variable Cost variable costs are any expense that increases or decreases with your production output. a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. Here are a number of examples of variable costs, all in a production setting: variable costing is a concept used in managerial. What Items Are Considered Variable Cost.

From dxonqlntu.blob.core.windows.net

Variable Costs And Fixed Costs at Eddie Matthews blog What Items Are Considered Variable Cost As production increases, these costs. variable costs are any expense that increases or decreases with your production output. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. Tvc = total quantity of output * vc per unit of output. Here are a number of examples of. What Items Are Considered Variable Cost.

From www.vecteezy.com

Fixed cost with no change in quantity of goods compare with variable cost with changes in What Items Are Considered Variable Cost Tvc = total quantity of output * vc per unit of output. types of variable costs. Here are a number of examples of variable costs, all in a production setting: a variable cost is the price of raw materials, labor, and distribution associated with each unit of product or service you sell. examples of variable costs include. What Items Are Considered Variable Cost.

From wealthnation.io

How to Balance Fixed Expenses with Variable Costs Wealth Nation What Items Are Considered Variable Cost As production increases, these costs. a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. Examples of variable costs include. examples of variable costs include a manufacturing company's costs of raw. What Items Are Considered Variable Cost.

From educationisaround.com

Let’s Understand more about Average Variable Cost Education Is Around What Items Are Considered Variable Cost a variable cost is any corporate expense that changes along with changes in production volume. Examples of variable costs include. examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. What Items Are Considered Variable Cost.